Menu

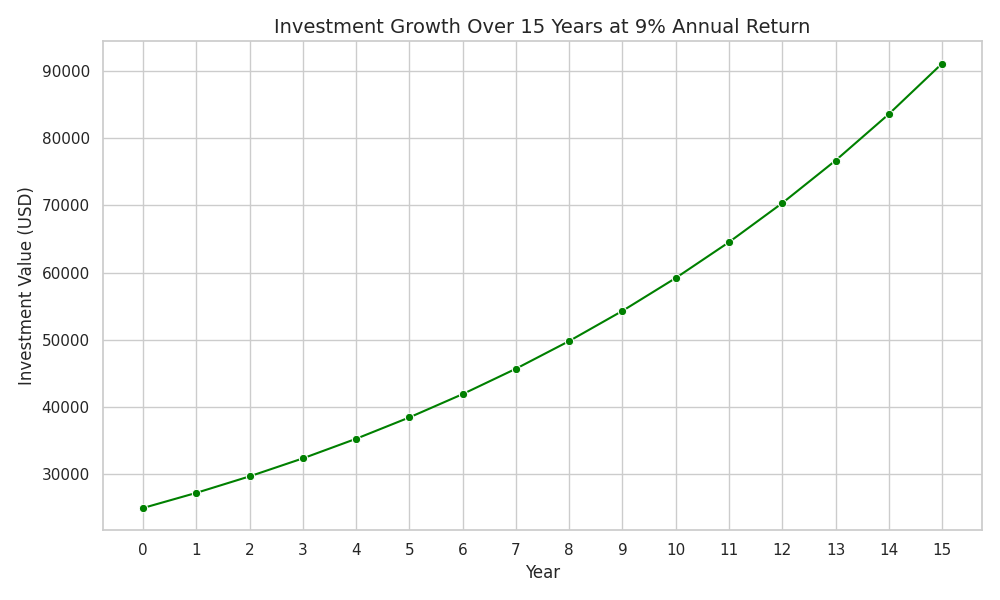

Here’s a visual representation of how a $25,000 investment grows over 15 years with a consistent 9% annual return and no losses 📈:

Each year builds on the last, thanks to compounding—so the curve steepens as time goes on. It’s an illustration of how time and consistency can turn modest capital into serious gains.

If you’re exploring real estate or mortgage note investments, this kind of compounding model can help forecast long-term returns.

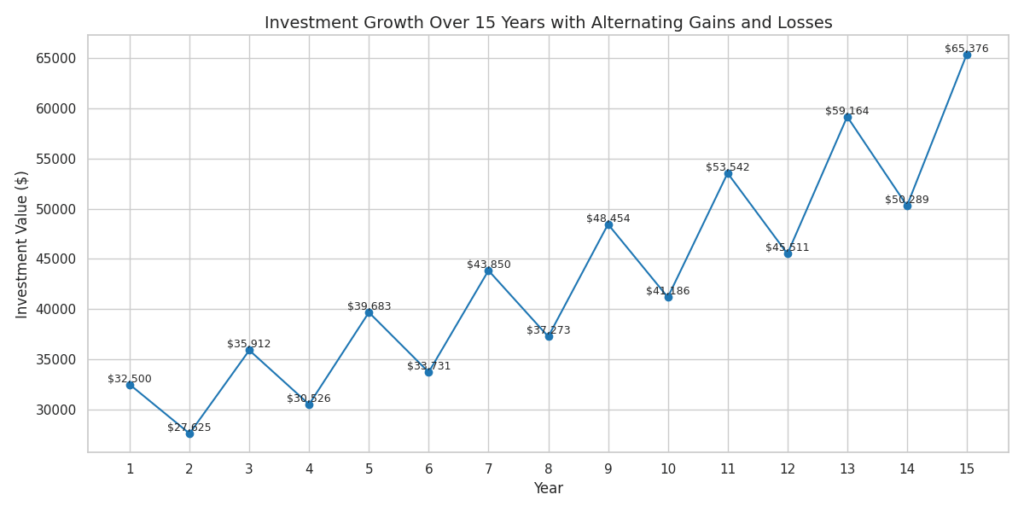

Here’s your custom investment growth graph based on the alternating pattern of +30% gains and −15% losses over 15 years, starting with $25,000 📈📉:

Here’s your custom investment growth graph based on the alternating pattern of +30% gains and −15% losses over 15 years, starting with $25,000 📈📉:

Restructure the note-terms, interest rate, payment amount, debt forgiveness and unpaid balances- This can provide the borrower with the breathing room needed to meet their financial obligations while still ensuring that the lender eventually receives full repayment. There are a multitude of ways to create a win-win scenario for the lender and the borrower

Last case scenario- Borrower turns over the keys to the house and the lender must foreclose on the house and re-gain possession of the real estate asset

It’s crucial for both parties to maintain open communication throughout the process and work collaboratively to find a solution that addresses the borrower’s financial challenges while minimizing the financial impact on the lender. Legal and financial advice should be sought to ensure that any agreements reached are fair, legal, and well-documented.

The value of the underlying real estate collateral can fluctuate due to market conditions, economic factors, or property-specific issues. A decrease in property value may affect the note’s security, especially if the borrower defaults and the property is sold to recover the investment.

The primary risk is that the borrower may default on the promissory note, failing to make the agreed-upon payments. This could result from financial hardship, economic downturns, or other unforeseen circumstances.

Promissory notes are often less liquid than other forms of investments. It may be challenging to sell or trade them on short notice, limiting the investor’s ability to quickly convert the investment into cash.

Investors in real estate promissory notes should carefully assess these risks, conduct thorough due diligence, and consider consulting with financial and legal professionals before making investment decisions. Diversification and a well-structured risk management strategy can also help mitigate potential downsides.

A mortgage is a legal agreement between two parties— the borrower (mortgagor) and the lender (mortgagee)—to secure a loan for real estate purchase. This agreement places a lien on the property, allowing the lender to reclaim the property through a foreclosure process if the borrower defaults on the loan. Mortgages typically involve a judicial foreclosure process, meaning that if the borrower defaults, the lender must go through the court system to initiate foreclosure.

A trust deed, or deed of trust, is a security instrument used in some states to secure a loan on real estate. Unlike a mortgage, a trust deed involves three parties:

The trustee holds the legal title of the property in trust for the lender, acting as an impartial third party. If the borrower defaults, the trustee can initiate a non-judicial foreclosure process, which doesn’t require court involvement and is often faster than a judicial foreclosure.

A land contract is a seller-financed agreement where the seller and buyer (borrower) make an installment agreement, typically without involving a traditional lender. The buyer makes payments directly to the seller, who retains legal ownership of the property until the debt is fully paid. If the buyer defaults, the seller may reclaim the property based on specific terms within the contract, which can vary by state.

|

Aspect

|

Mortgage

|

Trust Deed

|

Land Contract

|

|---|---|---|---|

|

Definitiion

|

Loan secured by real estate, typically through a judical process

|

Loan secured with title held by a trustee

|

Seller-financed loan where the seller holds title until fully paid

|

|

Parties Involved

|

2 Parties:

Mortgagor (Borrower) Mortgagee (Lender) |

3 Parties:

Trustor(Borrower) Trustee (Escrow Company) Beneficiary (Lender) |

2 Parties:

Buyer Seller |

|

Lien

|

Places a lien on the property

|

Places a lien on the property

|

Seller retains legal ownership until loan is fully paid

|

|

Recorded Debt

|

Debt recorded in county where the property is located

|

Debt recorded in county where the property is located

|

Agreement terms vary but recorded similarly in many cases

|

|

Foreclosure Type

|

Judicial (court-involved)

|

Non-Judicial (handled ourside court)

|

Varies by state; typically simpler repossession by seller

|

|

Security Instrument

|

Based on state foreclosure laws

|

Based on state foreclosure laws

|

Based on state contract and property laws

|

Not as painful as you think…

| Aspect | Tax-Deferred Investment Growth | Taxable Investment Growth |

|---|---|---|

| Tax Treatment | Gains and income are tax-deferred until withdrawal | Subject to annual taxes on gains, dividends, and interest income |

| Compounding Effect | Enhanced compounding due to tax deferral | Compounded returns are reduced by annual taxes |

| Withdrawal Taxation | Taxes applied upon withdrawal as ordinary income | Taxes on capital gains and dividends (vary by type) |

| Annual Tax Drag | No annual tax obligation on gains | Annual reduction in returns due to taxes |

| Time Horizon Suitability | Particularly advantageous for long-term investors | Suitable for short- to medium-term investment goals |

| Flexibility | Withdrawals may have penalties before retirement age | Liquidity and flexibility in managing investments |

| Tax Efficiency Strategies | Limited tax-loss harvesting opportunities | Tax-loss harvesting available for capital losses |

Never heard of a Self-Directed IRA? Or Wall Street Bankers don’t want you to know that an IRA account can hold more than just stocks, bonds, mutual funds, Exchange Traded Funds (EFTs) and Certificates of Deposits.

Probably because the large IRA companies, such as Fidelity, Charles Schwab, JP Morgan and Merrill Lynch don’t ‘sell’ or ‘offer’ mortgage promissory notes, and therefore you cannot have a note held with these IRA custodians.

Many lesser know Self Directed IRA custodians are available through a simple Google search and there are restriction on certain transactions.

Learn How To Invest In Profitable Mortgage Notes